Employee Self-Service Instructions

- Payslip Online Navigation Guide

- Direct Deposit Online Navigation Guide

- Electronic Form W-2 Tax Statement

- Online Electronic W-4 Tax Form

Payslip Online Navigation Guide

Log in UNF Service Now and follow the instructions Workday: Viewing Your Payslip

For further questions regarding the Pay Stub, please contact the UNF Payroll Office at (904) 620-2992 or payroll@unf.edu.

Direct Deposit Online Navigation Guide

Log in UNF Service Now and follow the instructions Workday: Set Up Direct Deposit

For further questions regarding payment elections, please contact the UNF Payroll Office at (904) 620-1192 or payroll@unf.edu.

IMPORTANT: To protect the employee direct deposit information, employees must be connected to the UNF network (physically on campus or on the VPN). The Payment Elections changes are restricted to the following locations:

- For On-Campus Computers

- Via the campus computer network

- Via campus WIFI network

- For Off-Campus Computers

- Via the FortiClient VPN software installed on Windows or Mac

- UNF VPN instructions can be found here: https://unf.service-now.com/help?id=kb_article&sysparm_article=KB0011174

- Workday will not allow Payment Election changes if the employee is logged into the VPN Browser via https://vpn.unf.edu.

- Via the UNF Azure Virtual Desktop

- Azure Virtual Desktop instructions can be found here: https://unf.service-now.com/help?id=kb_article&sysparm_article=KB0011119

- Via the FortiClient VPN software installed on Windows or Mac

Electronic Form W-2 Tax Statement

As an alternative to a paper Form W-2 Wage and Tax Statements, University of North Florida employees may elect to receive their Form W-2 Wage and Tax Statements electronically online through the myWings Employee-Self Service System. Please read the entirety of this notice and provide your consent to receive all future W-2 Wage and Tax Statements exclusively in electronic format.

This is a guide for you to give consent to Form W-2 on Workday

Log in Service Now to follow the instructions Workday: Give Consent to form W-2

Advantages of the electronic Form W-2 Wage and Tax Statement:

- Earlier employee access to the Form W-2 Tax and Wage Statement

- The electronic Form W-2 Wage and Tax Statement can never be lost, stolen, delayed or misplaced by the U.S. postal service or by the employee.

- Accessibility to the electronic Form W-2 Wage and Tax Statement from anywhere the employee has access to a computer.

- Access to the form is securely protected through UNF Workday portal.

- The electronic copy will contain all information and formatting required by the IRS.

Consent to Receive Form W-2 Wage and Tax Statement in electronic format in lieu of paper form.

The Internal Revenue Service (IRS) allows the use and distribution of Form W-2 Wage and Tax Statements in electronic form in lieu of paper forms. In order to do so, employees must consent to receive their Form W-2 Wage and Tax Statements in electronic format by completing the following steps:

Notice: Employees who consent to receive their Form W-2 Wage and Tax Statement online will not receive a paper copy of the Form W-2 Wage and Tax Statement. If an employee does not consent, they will continue to receive a paper copy of the Form W-2 Wage and Tax Statement and will be mailed to their permanent/legal address. An employee who chooses to receive their Form W-2 Wage and Tax Statement online can also receive a paper copy of the W-2 Wage and Tax Statement by contacting the Payroll Office. Request for a paper copy does not withdraw the employee's consent for electronic delivery of all future W-2 Wage and Tax Statements. The employee can change their option and withdraw consent to online delivery by unchecking the consent check box and clicking the Submit button, by e-mail or other written notice to:

University of North Florida - Payroll Office

1 UNF Drive, Hicks Hall, Bldg. 53, 2nd Floor, Suite 2850 Jacksonville, FL 32224

Phone:

E-mail: payroll@unf.edu

If consent is withdrawn, it will only be effective for W-2 Wage and Tax Statements not yet issued. The provision of an employee's Form W-2 Wage and Tax Statement by electronic format will automatically cease upon the employee's termination of employment with the University of North Florida.

Corrected W-2's and Paper Copies

If you received an electronic W-2 that is subsequently corrected, you will receive a corrected W-2 electronically and you will be notified that myWings has been updated within 30 days. If the email is returned as undeliverable and you have not provided a new e-mail address, the corrected W-2 or notice will be furnished to you by mail or in person. Corrected W-2s will be available on myWings until October 15 or the next business day if it falls on a Saturday, Sunday or legal holiday, or 90 days after the corrected form is posted, whichever is later.

Updating Employee Contact Information

Employees are responsible for updating their contact information. You may make changes to your permanent and mailing addresses on Workday by completing the following steps or by contacting the Office of Human Resources or Payroll Office.

This is a guide for you to update your Contact Details on Workday

Log in Service Now to follow the instructions Workday: Contact Details

If your employment with the University ends, any W-2 will be provided in paper format.

The hardware and software requirements needed to access and print electronic version of the W-2 form include a device with internet access, a current or latest web browser, Adobe Acrobat Reader. (optional to save the W-2 form in soft copy), and a printer capable of printing the W-2 form in landscape layout. The electronic version of the W-2 form will be available on UNF's mywings portal for at least 5 years from its original posting.

All employees should be cognizant that the Form W-2 Wage and Tax Statement, even when provided electronically, should print the W-2 Wage and Tax Statement for personal record keeping. Each year's online electronic W-2 Tax Statements will remain on myWings Employee Self-Service through October 15th.

For any additional questions, please contact the UNF Payroll Office at

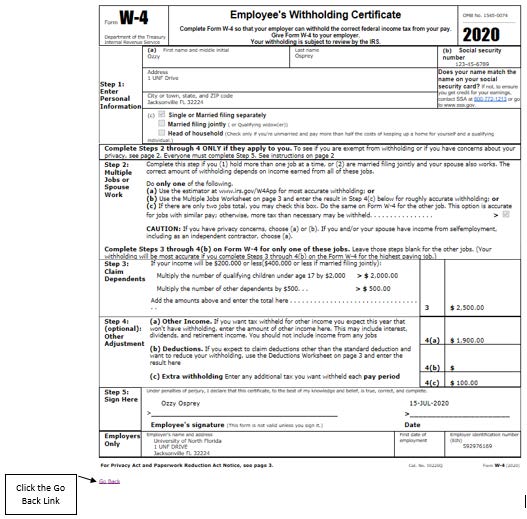

Online Electronic W-4 Tax Form

This is a guide for you to view or update your W-4 Tax elections :

Log in UNF Service Now and follow instructions How to View/Update Employee W-4 Tax Elections

Save a copy of your Tax Update Confirmation

The Tax Update Confirmation webpage to confirm the changes is displayed. It is recommended to view, print and/or save a soft copy of your updated W-4 Withholding Certificate tax form for your personal records. To do so:

- At the W4 Tax Update Confirmation webpage, select the W-4 Employee's Withholding Allowance Certificate link.

- The W-4 Tax Exemptions/Allowances webpage is displayed. Click the Print button.

A representation of your updated W-4 Employee's Withholding Allowance Certificate tax form is displayed. Here you can print and/or save a soft copy of your updated W-4 tax form.

You will receive a system generated email confirming your updated W-4 Employee's Withholding Allowance Certificate information.

For further questions regarding the online electronic W-4 tax form, please contact the UNF Payroll Office at (904) 620-2992, (904) 620-2984 or payroll@unf.edu